Acquisition of Ex-Tech Plastics

May 28, 2021 — (Vancouver, BC) good natured Products Inc. (the “Company” or “good natured®”) (TSX-V: GDNP), a North American leader in earth-friendly plant-based products, today announced that, through wholly owned subsidiaries, it has closed the acquisition of all of the operating assets of Ex-Tech Plastics Inc. (“Ex-Tech”) and real estate assets owned by a related company ETP Inc. for cash consideration of approximately USD $14.1 million (the “Acquisition”). The terms of the Acquisition were first announced on May 5, 2021.

“We’re very pleased to announce the completion of this Acquisition and welcome everyone at Ex-Tech to the good natured® family,” said Paul Antoniadis, CEO of good natured®. “Ex-Tech’s trailing twelve-month revenue of approximately CAD $33 million for the period ended December 31, 2020, will significantly accelerate our revenue growth for the back half of this calendar year.”

Paul added: “I would like to express my appreciation to all team members and parties involved in contributing to the Ex-Tech Acquisition. We are extremely excited to deepen our relationship with a company that we have a long standing and successful relationship with. The combined companies will create one of North America’s leading sheet extruders, serving over 200 thermoforming customers across North America.”

Founded in 1982, Ex-Tech is located 90 minutes from Chicago in Richmond, Illinois and produces a variety of plastic sheet and film products, including extruded roll stock sheet for thermoformed packaging. Ex-Tech operates seven different extrusion lines in a dedicated 75,000 square foot facility on 9.5 acres of land. Ex-Tech’s 105 customers serve a diverse set of end markets, including retail, food, and medical packaging. Customers are primarily located in the midwestern and southwestern United States.

Key Highlights of the Acquisition:

• Ex-Tech generated revenue of approximately $25.8 million USD and net income of approximately $1.5 million USD in the calendar year ended December 31, 2020 (or “FY2020”)

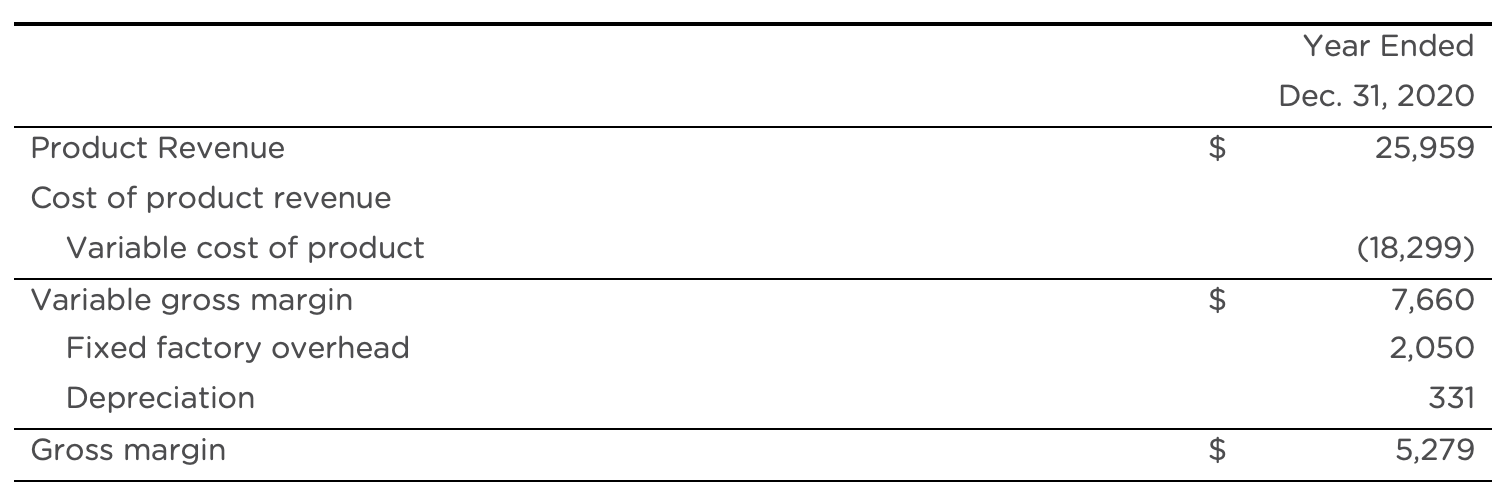

• Ex-Tech generated unaudited variable gross margin rate of approximately 30% and gross margin rate of approximately 21% in FY2020

• Adds 105 business-to-business (“B2B”) customers, growing the Company’s B2B segment to a total of approximately 600 customers

• Adds between $11.0 and $13.0 million USD (unaudited) of total assets to the Company’s balance sheet

• Ex-Tech delivered FY2020 adjusted EBITDA2 of approximately $2.6 million USD

• The current management team operating Ex-Tech will be joining the good natured® team

• Highly strategic and synergistic acquisition that is expected to be immediately accretive to shareholders on an adjusted EBITDA basis

• Expected to provide synergies of approximately $1.0 to $1.2 million USD in the twelve months following the close of the acquisition

• $3.3 million USD in net working capital acquired at closing

• Includes real estate with a current appraised value of approximately $4.2 million USD, resulting in a net price for the business and operating assets of $9.9 million USD

Key Strategic Highlights:

• Capacity to produce compostable (“PLA”) and plant-based PET (Bio-PET) roll stock to support organic growth and conversion of existing and future petroleum-based acquisition targets

• Significant potential for capacity and / or manufacturing capability expansion, with available land to add a 40,000 square feet facility and infrastructure at the existing facility in place to support additional extrusion and or thermoforming production lines, along with warehousing

• Minor customer overlap between Ex-Tech and Integrated Packaging Films that was acquired in December 2020, with the potential to open additional cross-selling opportunities

• Centrally located just 90 minutes outside of Chicago in Richmond, Illinois along major shipping corridors to provide easy access across much of the United States

• Ex-Tech’s facility includes 42 million pounds of annual production capacity on an annual basis and growth potential to approximately 60 million pounds with the addition of one standard high speed extrusion production line for which there is space and infrastructure available

• Opportunity to divest books of business that are not compatible for material transition to plant-based materials to support re-investment

Financing Details

The Company has secured the following financing, which has enabled it to complete the Acquisition and will fund related integration costs:

• $5.0 million USD term loan from a Canadian financial institution

• $2.8 million USD mortgage with American Community Bank & Trust

• $6.3 million USD in cash from the Company’s treasury

The Company’s material financing agreements with the Canadian financial institution and American Community Bank & Trust are available on SEDAR. The Acquisition was an arm’s length transaction. The asset purchase agreement in connection with the Acquisition has been previously filed on the Company’s profile at www.sedar.com.

The good natured® corporate profile can be found at: investor.goodnaturedproducts.com

About good natured Products Inc.

good natured® is passionately pursuing its goal of becoming North America’s leading earth-friendly product company by offering the broadest assortment of eco-friendly options made from plants instead of petroleum. We’re all about making it easy and affordable for business owners and consumers to switch to better everyday products® made from renewable materials and free from chemicals of concern.

Part of the sustainable consumer goods market, good natured® offers over 400 products and services through wholesale and retail channels, including our own e-commerce stores. From plant-based home organization products to compostable food containers, bioplastic industrial supplies and medical packaging, we’re focused on delivering a great customer experience to make more plant-based products readily accessible to more people as the path to deliver meaningful environmental and social impact.

For more information: goodnaturedproducts.com

On behalf of the Company:

Paul Antoniadis – Executive Chair & CEO

Contact: 1-604-566-8466

Investor Contact:

Spencer Churchill

Investor Relations

1-877-286-0617 ext. 113

invest@goodnaturedproducts.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibilities for the adequacy or accuracy of this release.

Non-GAAP financial measures

We have included in this press release certain non-GAAP measures that are used to evaluate the performance of Ex-Tech, including adjusted EBITDA and variable gross margin. The use of EBITDA by management allows for evaluation of Ex-Tech’s principal business activities as certain non-core items such as interest and finance costs, taxes, depreciation and amortization, and other non-cash items and one-time gains and losses are removed. The use of variable gross margins by management allows for evaluation of the core aspects of Ex-Tech’s profit margin as certain fixed items that are primarily outside Ex-Tech’s control, such as depreciation, repairs and maintenance, and utilities are excluded.

As non-GAAP measures generally do not have a standardized meaning, they may not be comparable to similar measures presented by other issuers. EBITDA and variable gross margin do not have a generally accepted industry definitions.

The following table provides a reconciliation of Ex-Tech’s unaudited FY2020 gross margin compared to variable gross margin for FY2020: (Stated in US$):

The following table provides a reconciliation of Ex-Tech’s FY2020 net income to Adjusted EBITDA FY2020:

Cautionary Statement Regarding Forward-Looking Information

This press release contains “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements can be identified by words such as: ”anticipate,” “intend,” “plan,” “budget,” “believe,” “project,” “estimate,” “expect,” “scheduled,” “forecast,” “strategy,” “future,” “likely,” “may,” “to be,” “could,”, “would,” “should,” “will” and similar references to future periods or the negative or comparable terminology, as well as terms usually used in the future and the conditional. Examples of forward-looking statements include, among others, the projected impact of completion of the Acquisition on the Company’s business, integration plans and potential benefits from the Acquisition, and the use of funds for integration costs.

By their nature, forward-looking statements involve known and unknown risks, uncertainties, changes in circumstances and other factors that are difficult to predict and many of which are outside of the Company’s control which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the Company’s current beliefs, expectations and assumptions regarding the future of its business, future plans and strategies, projections, anticipated events and trends, general market conditions, the economy and other future conditions. The Company’s actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results and financial conditions to differ materially from those indicated in the forward-looking statements include, among others, risks relating to general economic, market and business conditions.

The Company considers its assumptions to be reasonable based on currently available information, but cautions the reader that its assumptions regarding future events, many of which are beyond the control of the Company, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect the Company and its businesses. When relying on the Company’s forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The Company has assumed that the material factors referred to above will not cause such forward-looking statements and information to differ materially from actual results or events. However, there can be no assurance that such assumptions will reflect the actual outcome of such items or factors.

Other than as required under securities laws, the Company does not undertake to update this information at any particular time.

Forward-looking statements contained in this news release are based on the Company’s current estimates, expectations and projections regarding, among other things, sales volume and pricing which it believes are reasonable as of the current date. The reader should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.