Good Natured Products Inc. Announces Second Quarter 2023 Results

August 29, 2023 — (Vancouver, BC) good natured Products Inc. (the “Company” or “good natured®”) (TSX-V: GDNP) (OTCQX: GDNPF), a North American leader in plant-based products,today announced its financial results for the three months ended June 30, 2023 (“Q2 2023”).

Q2 2023 Highlights

- Revenue of $18.3 million compared to $25.5 million for the three months ended June 30, 2022 (“Q2 2022”) and $20.3 million for the three months ended March 31, 2023 (“Q1 2023”).

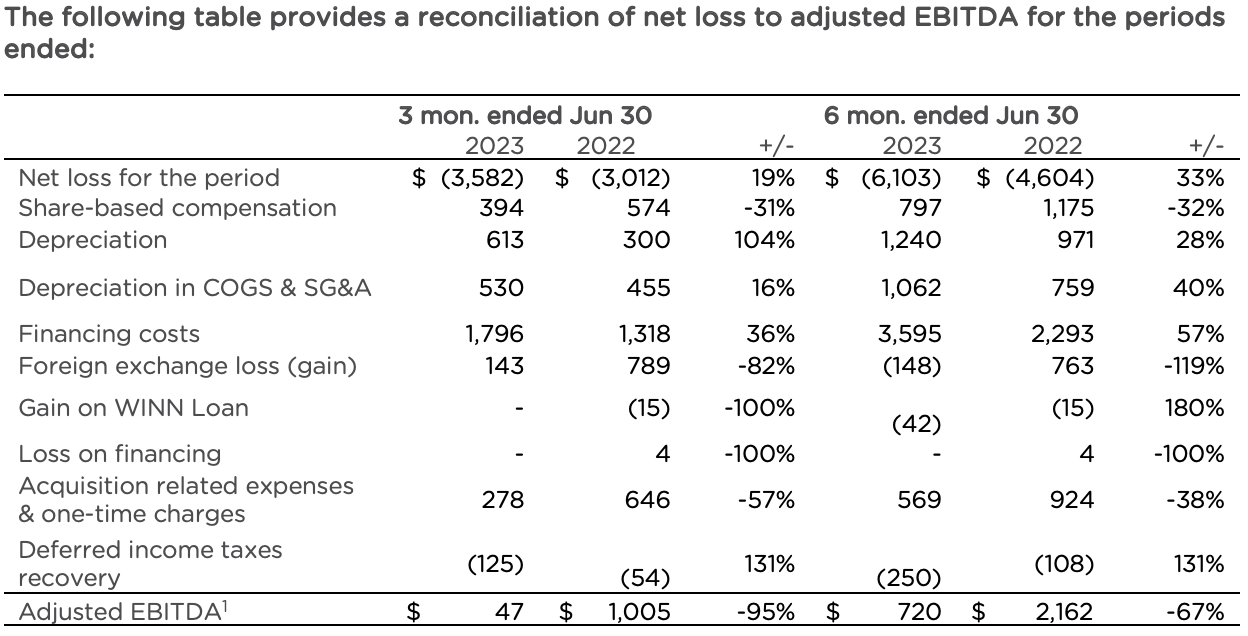

- Adjusted EBITDA1 of $0.1 million compared to $1.0 million in Q2 2022 and $0.7 million in Q1 2023.

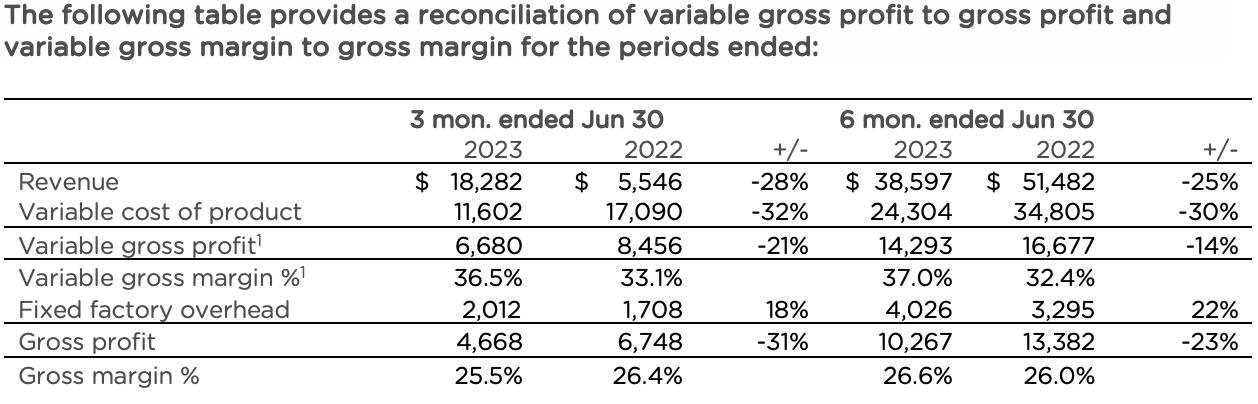

- Variable gross margin1 of 37% compared to 33% in Q2 2022 and 38% in Q1 2023.

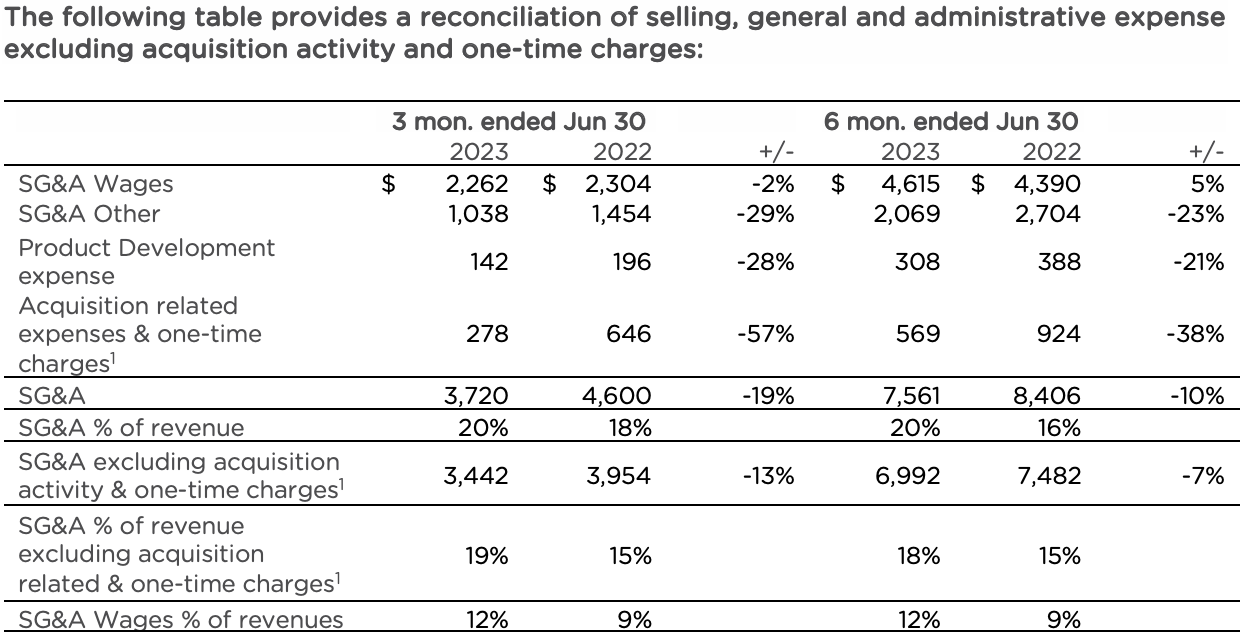

- SG&A expenses of $3.7 million compared to $4.6 million in Q2 2022 and $3.8 million in Q1 2023.

- Cash generated by operating activities was $0.1 million for the 6 months ended June 30, 2023 (“H1 2023”) compared to $1.4 million for the 6 months ended June 30, 2022 (“H1 2022”).

- Ending cash balance of $13.2 million compared to $11.9 million at December 31, 2022.

The Company’s Packaging business group delivered 83% year-over-year revenue growth largely due to the addition of new customers, cross selling new products to existing customers, and the acquisition of Houston-based FormTex Plastics in July 2022. Revenue declines were largely driven by lower third-party sales in the Company’s Industrial business group as a result of industry-wide declines in average selling prices, continued customer de-stocking, soft demand coupled with increased competitive pressure for commodity petroleum-based products, and an overall sector shift to just-in-time ordering.

“We keenly recognize the challenge for our business and stakeholders to cycle through reductions in quarterly revenue as we’ve navigated considerable macroeconomic volatility and supply chain normalization that we first identified in Q3 2022. Our outlook remains very positive about the continued strong growth in our Packaging business group, and our robust pipeline continues to perform with several new packaging deals expected to enter commercial production in the back half of the third quarter,” stated Paul Antoniadis, CEO of good natured®. “We also anticipate third party industrial sales to show signs of improving later this year and continue to proactively lower our SG&A spend through cost reduction initiatives, while we also look for ways to restructure and renegotiate our long-term debt.”

Q2 2023 Financial Overview

Revenue for Q2 2023 decreased 28% to $18.3 million as compared to $25.5 million for Q2 2022. The Packaging business group realized year-over-year revenue growth of 83% driven by organic growth as well as contribution from the FormTex acquisition completed in July 2022. This was offset by a year-over-year reduction in Industrial business group revenue.

Variable gross margin1 for Q2 2023 increased to 37% compared to 33% for Q2 2022. The increase in variable gross margin reflects the higher mix of revenue from the Packaging business group and productivity enhancements in the variable cost of products. Gross margin for Q2 2023 and Q2 2022 was 26%.

Selling, general and administrative expenses (“SG&A”) in Q2 2023 decreased by 19% compared to Q2 2022. The decrease in SG&A expenses reflects the Company’s efforts to reduce costs through a year-over-year headcount reduction of 31 people, renegotiating terms across the Company’s service providers and suppliers, and through process improvements designed to take out costs and/or improve productivity. The decline in SG&A was partially offset by the incremental headcount and SG&A associated with the July 2022 acquisition of FormTex. Excluding SG&A expenses associated with the FormTex acquisition, Q2 2023 SG&A excluding acquisition activity and one-time charges, declined 22% on a year-over-year basis. On an annualized basis, Q2 2023 SG&A totalled $14.9 million as compared to $17.9 million in the 2022 fiscal year, representing $3.0 million in run-rate cost savings.

The Company’s Adjusted EBITDA1 for Q2 2023 was $0.1 million compared to $1.0 million in Q2 2022. The decline in adjusted EBITDA1 in Q2 2023 and H1 2023 reflects the decline in revenue and gross profit dollars, which were not fully offset by the decline in SG&A, and specifically fulfilment and logistics costs.

The Company incurred a net loss of $3.6 million in Q2 2023 compared to a net loss of $3.0 million in Q2 2022.

Cash Flow & Balance Sheet Overview

The Company strengthened its liquidity with the completion of a brokered private placement with net proceeds of $4.4 million in June 2023, as well as reducing its long-term debt by $1.5 million at June 30, 2023 compared to December 31, 2022. Cash flow generated by operating activities for H1 2023 was $0.1 million compared to $1.4 million in H1 2022. Cash use by investing activities in H1 2023 was $1.4 million compared to $3.3 million in H1 2022. As at June 30, 2023, net working capital was $9.2 million compared to $10.0 million as at December 31, 2022.

The Company continues to focus on ways to restructure and renegotiate its long-term debt obligations. During the quarter, the Company successfully renegotiated a June 2023 payment of $0.5 million due to the Government of Canada’s Western Innovation Initiative program (“WINN”) into monthly installments to be paid over a 24-month period. The Company also intends to relocate its coating and warehousing operations at a leased location adjacent to its Ayr facility by the end of the fiscal year, which is expected to reduce its long-term lease obligations by $0.7 million and reduce operating expenses by approximately $0.2 million.

As at June 30, 2023, the Company’s total asset to liability ratio was 1.21 compared to 1.22 as at December 31, 2022.

The Company’s Q2 2023 financial statements and Management’s Discussion and Analysis are available on SEDAR at sedar.com and on the Company’s investor website at investor.goodnaturedproducts.com.

Q2 2023 Results Conference Call

The Company will hold a conference call to discuss its financial results for Q2 2023, hosted by Paul Antoniadis, Executive Chair & CEO, and Kerry Biggs, Chief Financial Officer, on August 29, 2023 at 11:00 AM Eastern / 8:00 AM Pacific time.

Date: August 29, 2023

Time: 11:00 AM ET / 8:00 AM PT

Toll-Free: 1-888-396-8049 International: +1-416-764-8646

Conference ID: 18517762

Participants are asked to dial in 10 minutes prior to the start of the call.

A replay of the call will be available approximately two hours after its completion through to September 12, 2023. The replay will be available by dialing 1-877-674-7070 or +1-416-764-8692 and by using the passcode 517762.

The good natured® corporate profile can be found at: investor.goodnaturedproducts.com

About good natured Products Inc.

good natured® is passionately pursuing its goal of becoming North America’s leading earth-friendly product company by offering the broadest assortment of plant-based products made from rapidly renewable resources instead of fossil fuels. The Company is focused on making it easy and affordable for business owners and consumers to shift away from petroleum to better everyday products® that use more renewable materials, less fossil fuel, and no chemicals of concern.

good natured® offers over 400 products and services through wholesale, direct to business, and retail channels. From plant-based home organization products to certified compostable food containers, bio-based industrial supplies and medical packaging, the Company is focused on making plant-based products more readily accessible to people as a means to create meaningful environmental and social impact.

For more information: goodnaturedproducts.com

On behalf of the Company:

Paul Antoniadis – Executive Chair & CEO

Contact: 1-604-566-8466

Investor Contact:

Spencer Churchill

Investor Relations

1-877-286-0617 ext. 113

invest@goodnaturedproducts.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibilities for the adequacy or accuracy of this release.

Non-GAAP Financial Measures

We have included in this press release a discussion of the Company’s variable gross profit, variable gross margin, SG&A excluding acquisition activity and one-time charges, and adjusted EBITDA all non-GAAP measures, for Q1 2023, Q2 2023, H1 2023, Q2 2022 and H1 2022 to provide, what management believes, is a meaningful comparison of the Company’s performance in Q2 2023 and H1 2023. These non-GAAP measures do not have standardized meanings, and therefore may not be comparable to similar measures presented by other issuers. Variable gross profit, variable gross margin, SG&A excluding acquisition activity and one-time charges, and adjusted EBITDA are more fully defined and discussed in the Company’s Q2 2023 Management’s Discussion and Analysis under the heading “non-IFRS financial measures”, which is available on the Company’s SEDAR profile at www.sedar.com and on the Company’s investor website at investor.goodnaturedproducts.com.

Cautionary Statement Regarding Forward-Looking Information

This news release contains forward-looking information within the meaning of securities laws including statements related to Company plans and focuses for 2023, the upcoming results conference call and management’s outlook for 2023.

By their nature, forward-looking statements involve known and unknown risks, uncertainties, changes in circumstances and other factors that are difficult to predict and many of which are outside of the Company’s control which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Forward-looking information contained in this news release is based on our current estimates, expectations and projections regarding, among other things, future plans and strategies, projections, future market and operating conditions, supply conditions, end customer demand conditions, anticipated events and trends, general market conditions, the economy, financial conditions, sales volume and pricing, expenses and costs, and other future conditions which we believe are reasonable as of the current date. Important factors that could cause actual results and financial conditions to differ materially from those indicated in the forward-looking statements include, but are not limited to: future capital needs and uncertainty of additional financing, risks relating to general economic, market and business conditions and unforeseen delays in the realization of the Company’s plans, risks related to the loss of key manufacturing equipment, capability or facilities, the performance of plant-based materials and the ability of the Company’s products and packaging to meet significant technical requirements, changes in raw material supply and costs, labour availability and labour costs, fluctuations in operating results, and other related risks as more fully set out in the Annual Information Form of the Company and other documents disclosed under the Company’s filings at www.sedar.com. The reader should not place undue importance on forward-looking information and should not rely upon this information as of any other date.

If relying on the Company’s forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The Company has assumed that the material factors referred to herein will not cause such forward-looking statements and information to differ materially from actual results or events. However, there can be no assurance that such assumptions will reflect the actual outcome of such items or factors.

Other than as required under securities laws, we do not undertake to update this information at any particular time.

All forward-looking information contained in this news release is expressly qualified in its entirety by this cautionary statement.

1. A non-GAAP financing measure. Please refer to the “Non-GAAP Financial Measures” above for an explanation of these measures and reconciliation to the Company’s financial results reported in accordance with GAAP.